Unit Descriptions

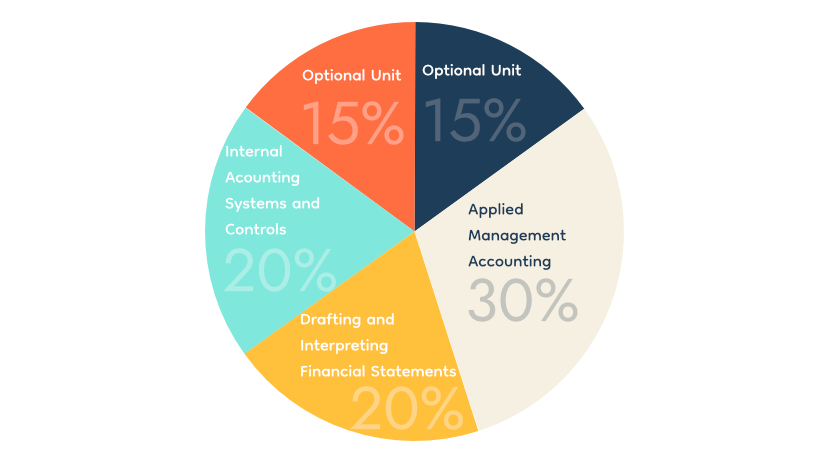

The following three units are compulsory.

1. Applied Management Accounting

This unit is worth 30% of the overall grade.

This unit delves into strategic financial planning, encompassing budget preparation, analysis, and control. You'll learn to align budgets with organisational goals, allocate resources effectively, and make informed decisions based on insightful financial data.

Learning outcomes

- Understand and implement the organisational planning process

- Use internal processes to enhance operational control

- Use techniques to aid short-term and long-term decision making

- Analyse and report on business performance

2. Drafting and Interpreting Financial Statements:

This unit is worth 20% of the overall grade.

Building on prior knowledge, this unit takes a closer look at complex financial reporting standards for limited companies. It covers consolidated accounts, group structures, and the nuanced interpretation of financial statements within the Q2022 syllabus.

Learning outcomes

- Understand the reporting frameworks that underpin financial reporting

- Draft statutory financial statements for limited companies

- Draft consolidated financial statements

- Interpret financial statements using ratio analysis

3. Internal Accounting Systems and Controls

This unit is worth 20% of the overall grade.

This unit delves into the heart of financial system integrity. You'll explore internal controls, risks, and learn to implement robust mechanisms to safeguard financial data and mitigate potential risks.

Learning outcomes

- Understand the role and responsibilities of the accounting function within an organisation

- Evaluate internal control systems

- Evaluate an organisation’s accounting system and underpinning

- procedures

- Understand the impact of technology on accounting systems

- Recommend improvements to an organisation’s accounting system

Optional Units

A student would need to choose two from the following optional units.

1. Business Tax

This would be one of the two optional units and would be worth 15% of the overall grade.

Navigating intricate business taxation, this unit explores corporate tax, and capital gains tax. Students will delve into tax implications and the importance of maintaining accurate tax compliance.

Learning outcomes

- Prepare tax computations for sole traders and partnerships

- Prepare tax computations for limited companies

- Prepare tax computations for the sale of capital assets by limited companies

- Understand administrative requirements of the UK’s tax regime

- Understand the tax implications of business disposals

- Understand tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs

2. Personal Tax

This would be one of the two optional units and would be worth 15% of the overall grade.

Focusing on personal taxation, this unit covers income tax, national insurance contributions, inheritance tax, and other taxes applicable to individuals. Students will master calculating tax liabilities and exemptions accurately.

Learning outcomes

- Understand principles and rules that underpin taxation systems

- Calculate UK taxpayers’ total income

- Calculate income tax and National Insurance contributions (NICs) payable by UK taxpayers

- Calculate capital gains tax payable by UK taxpayers

- Understand the principles of inheritance tax

3. Cash and Financial Management

This would be one of the two optional units and would be worth 15% of the overall grade.

This unit hones your skills in cash and financial management, an essential aspect of any business. You'll learn to manage cash flow effectively, ensuring liquidity and financial stability.

Learning outcomes

- Prepare forecasts for cash receipts and payments

- Prepare cash budgets and monitor cash flows

- Understand the importance of managing finance and liquidity

- Understand ways of raising finance and investing funds

- Understand regulations and organisational policies that influence decisions in managing cash and finance

4. Credit and Debt Management

This would be one of the two optional units and would be worth 15% of the overall grade.

Addressing credit and debt management, this unit covers techniques to manage credit effectively, handle debt, and mitigate associated risks.

Learning outcomes

- Understand relevant legislation and contract law that impacts the credit control environment

- Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures

- Understand the organisation’s credit control processes for managing and collecting debts

- Understand different techniques available to collect debts

5. Audit and Assurance

This would be one of the two optional units and would be worth 15% of the overall grade.

Delving into audit and assurance processes, this unit provides insights into how audits are conducted, and the importance of ensuring financial accuracy and compliance.

Learning outcomes

- Demonstrate an understanding of the audit and assurance framework

- Demonstrate the importance of professional ethics

- Evaluate the planning process for audit and assurance

- Evaluate procedures for obtaining sufficient and appropriate evidence

- Review and report findings